InvoiceNow Educational Videos

InvoiceNow: The What, Why and How | Part 1: About InvoiceNow

InvoiceNow: The What, Why and How | Part 2: Benefits of InvoiceNow

InvoiceNow: The What, Why and How | Part 3: Getting Started with InvoiceNow

InvoiceNow: The What, Why and How | Part 4: Project and Transformation Management

InvoiceNow: The What, Why and How | Part 5: Working with Peppol Format

InvoiceNow: The What, Why and How | Part 6: Solution Integration and Enhancements

InvoiceNow: The What, Why and How | Part 7: Adapting to Peppol PINT

InvoiceNow: The What, Why and How | Part 8: Adapting to Meet GST InvoiceNow Requirement

GST InvoiceNow Requirement

On 15 April 2024, The Inland Revenue Authority of Singapore (IRAS) announced that it will implement a phased adoption of InvoiceNow for GST-registered businesses starting from November 2025.

The adoption of InvoiceNow for invoice data submission to IRAS, extends the traditional four corner e-delivery model to a fifth corner. The overall system design includes funnelling copies of live invoices over InvoiceNow, and invoice data extracted from invoicing systems to IRAS system.

The technical specifications “Invoice Data Submission Specifications for IRAS GST InvoiceNow Requirement” is now available for service providers and GST-registered businesses to plan the enhancement of their systems.

Click here to download all the technical specifications, including the schematron files for solution extraction and example files.

The technical specification comprises of:

TX1 – Design Document

Overall system design

TX2 – Data Extraction and Transformation

Enhancements required for systems for both market solutions and GST-registered businesses

TX3 – Access Point Services

Enhancements required for Access Points

InvoiceNow Enterprise Best Practice Guide

The InvoiceNow Enterprise Best Practice Guide provides useful tips for enterprises with their own enterprise resource planning (ERP) systems.

Click here to download the guide: https://go.gov.sg/invoicenow-enterprise-guide

Peppol 4-Corner Model

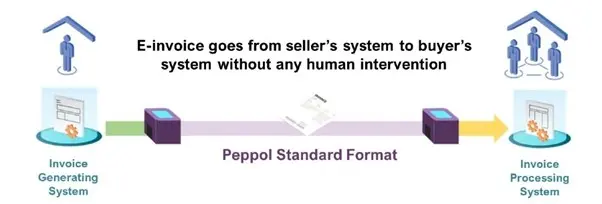

The Nationwide E-Invoicing Network (also known as InvoiceNow) adopts the Peppol framework which allows direct transmission of documents from one accounting/finance solution or in-house enterprise solution to another without human intervention, speeding up invoice processing which results in faster digital payment. This greatly reduces the time spent verifying invoices and chasing for payment.

In the Peppol network (also known as InvoiceNow), documents are exchanged using a common XML format known as the BIS (Business Interoperability Specifications). This common standard allows users to choose their preferred accounting/finance solution or in-house enterprise solution while being able to exchange documents with their partners who may not be using the same solution. Documents are exchanged through Access Points, which serve as gateways into the Peppol network. Access Points take up the responsibility of mapping documents into the standard format and sending them to the receiving Access Points through the Peppol network.

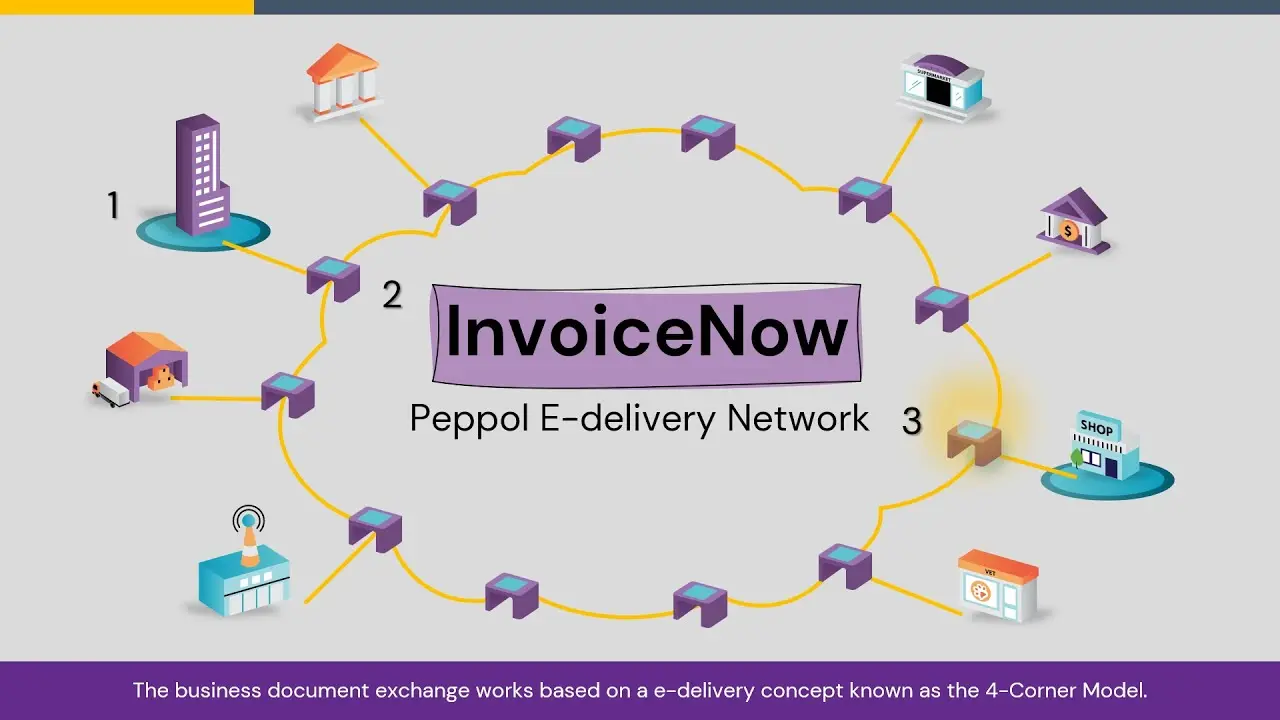

The Peppol network works based on a principle of a 4-corner model, illustrated above. In a transaction, the seller’s objective is to successfully send an invoice to the accounting/finance solution or in-house enterprise solution of the buyer. For documents that are sent out by the seller (corner 1), it will be converted into the common standard at its Access Point (corner 2). The global directory will provide the necessary information to corner 2 to identify the receiving Access Point (corner 3) for the documents to be sent through the network. Upon receiving the documents, corner 3 will map the documents into the preferred format of the buyer (corner 4).

InvoiceNow allows businesses to use an accounting/finance solution or in-house enterprise solution of their choice, connect once and connect to all.

Below is an explanatory video of how the 4-Corner Model concept, also known as the Peppol e-delivery concept, helps to deliver business documents such as e-invoice on the Peppol network.

Singapore Peppol Guide

The Singapore Peppol Guide provides official technical specifications for service providers implementing Peppol e-invoicing solutions in Singapore.

The Singapore Peppol Guide includes the following: Documentation for supported Peppol document types in Singapore

- Syntax requirements and XML schemas

- Business rules and validation requirements

- Singapore-specific code lists and identifiers

- Downloadable resources and sample files

The latest documents to be supported include:

- Advanced Ordering - Supports purchase orders, variations, and cancellations.

- SG BIS Order Balance - Enables buyers to communicate remaining delivery quantities to suppliers.

APs are required to implement Advanced Ordering and SG BIS Order Balance by 30 Sep 2025. For the test scripts and example files, refer to: https://go.gov.sg/advancedordering-aptest

IRSPs are required to implement Advanced Ordering and SG BIS Order Balance by 31 Dec 2025. For the test scripts and example files, refer to: https://go.gov.sg/advancedordering-irsptest

Singapore Peppol Directory

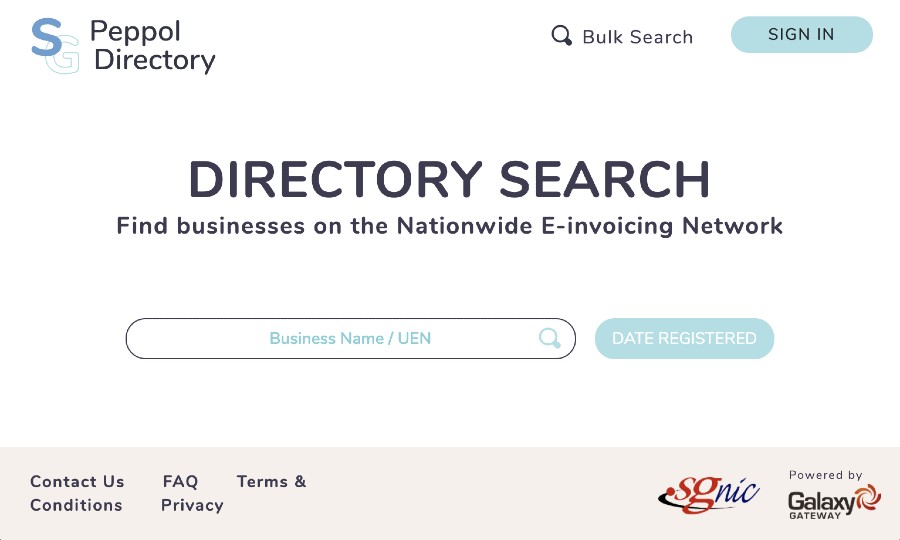

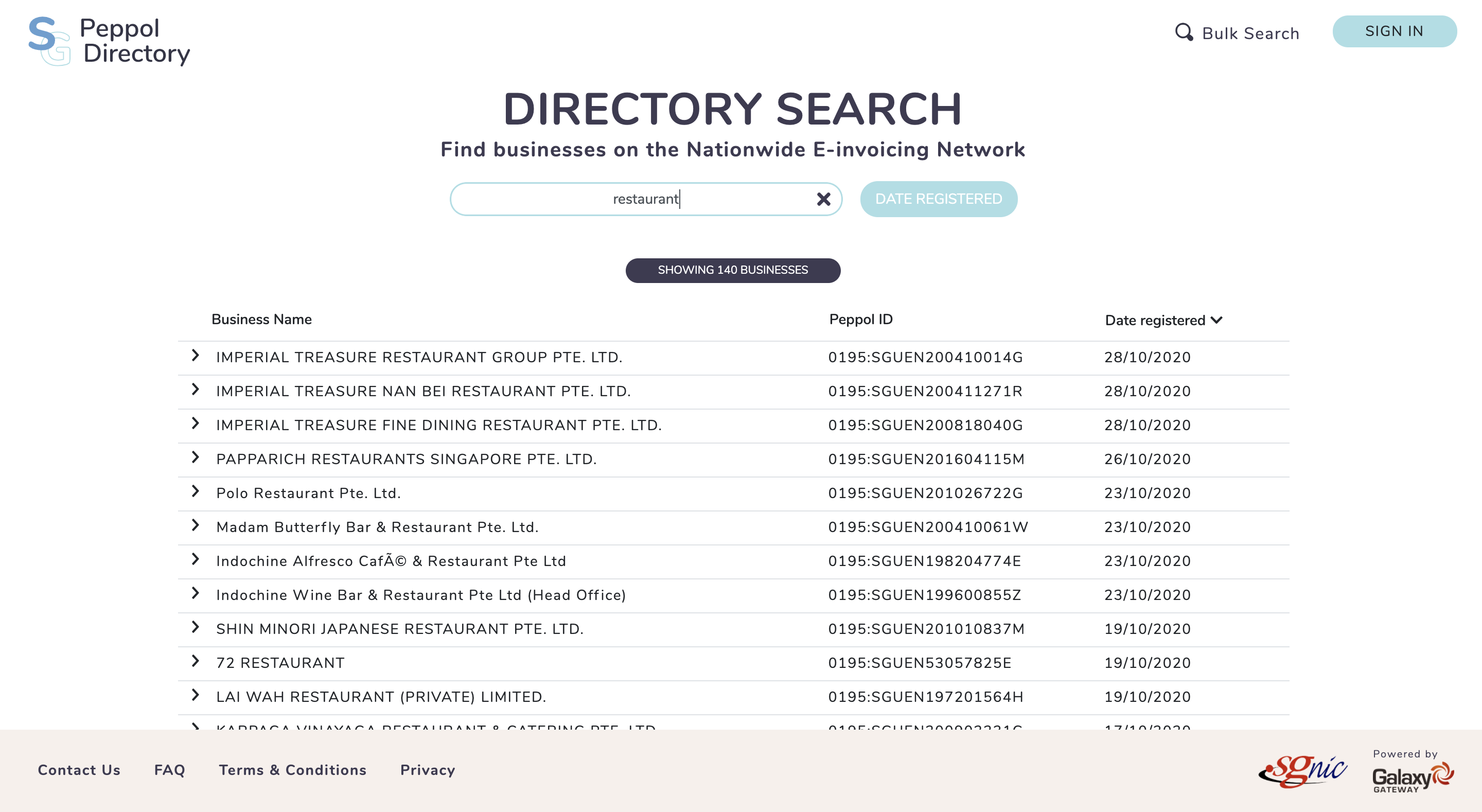

The SG Peppol Directory is a facility for searching Singapore businesses registered on InvoiceNow. It allows businesses to search for other companies registered on the Peppol network to send and receive documents electronically through InvoiceNow.

Watch the video guide below:

Simple search function

Perform a simple search for Singapore businesses who are registered on the Peppol network using their company name or UEN.

Successful searches will showcase all relevant companies with their full name, Peppol IDs, and the type of Peppol document they can receive.

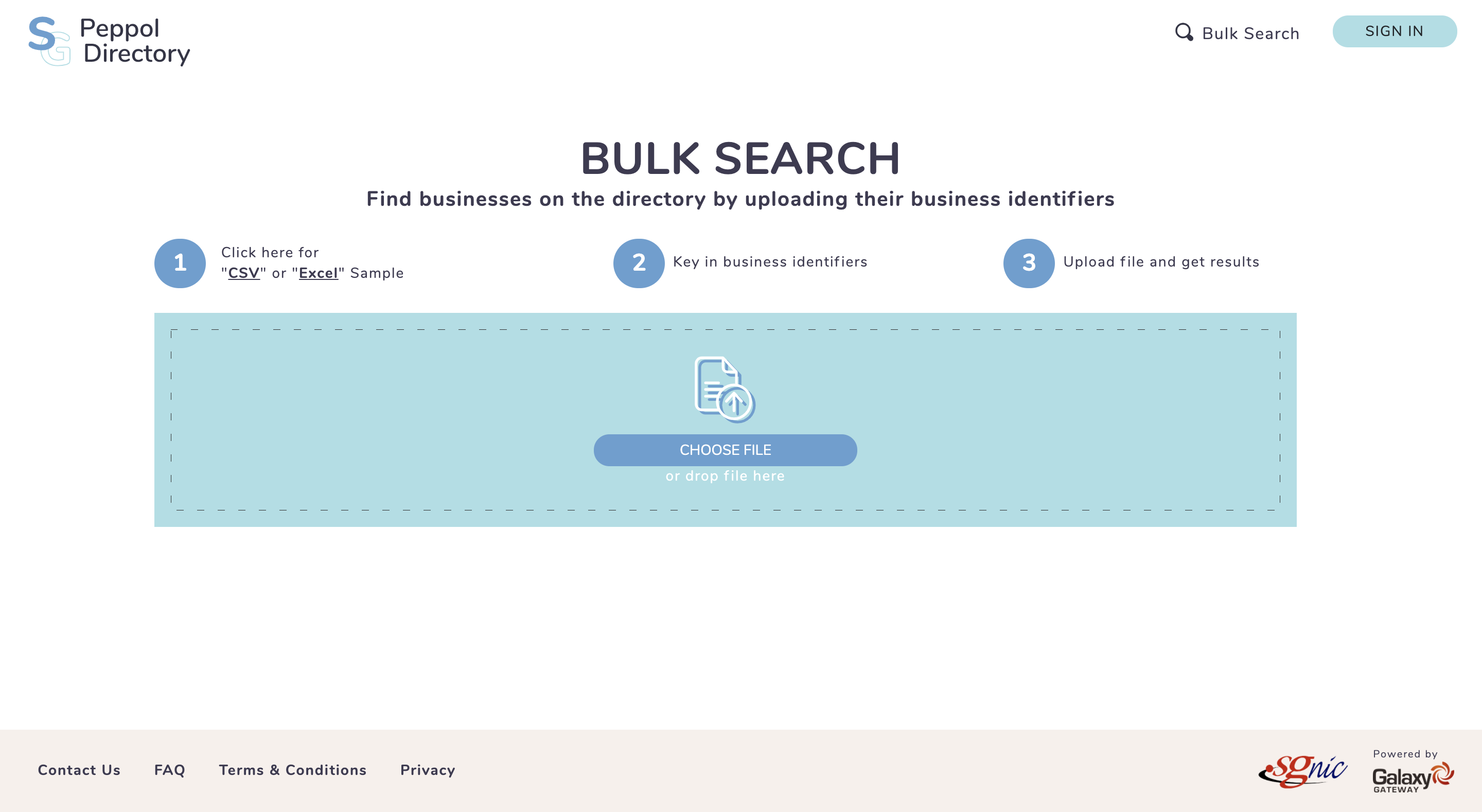

Bulk search function

Perform a single search of multiple companies using the bulk search feature. Simply upload a CSV or Excel file containing the list of UENs of companies and the result of the search will be downloaded automatically with the company names, Peppol IDs, and type of Peppol documents supported.

Registered accounts on SG Peppol Directory

Registered business users on the platform will be able to access the following features:

- Download the entire SG Peppol Directory in CSV format

- Set-up an API connectivity to the platform to carry application initiated UEN searches

Validex tool

The Validex tool is free tool for checking the supported electronic documents on InvoiceNow.

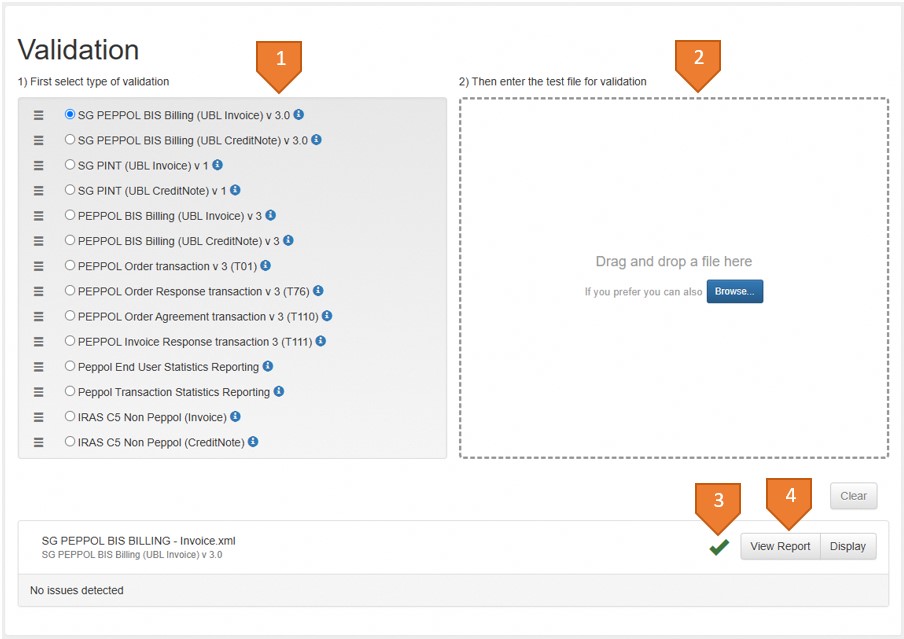

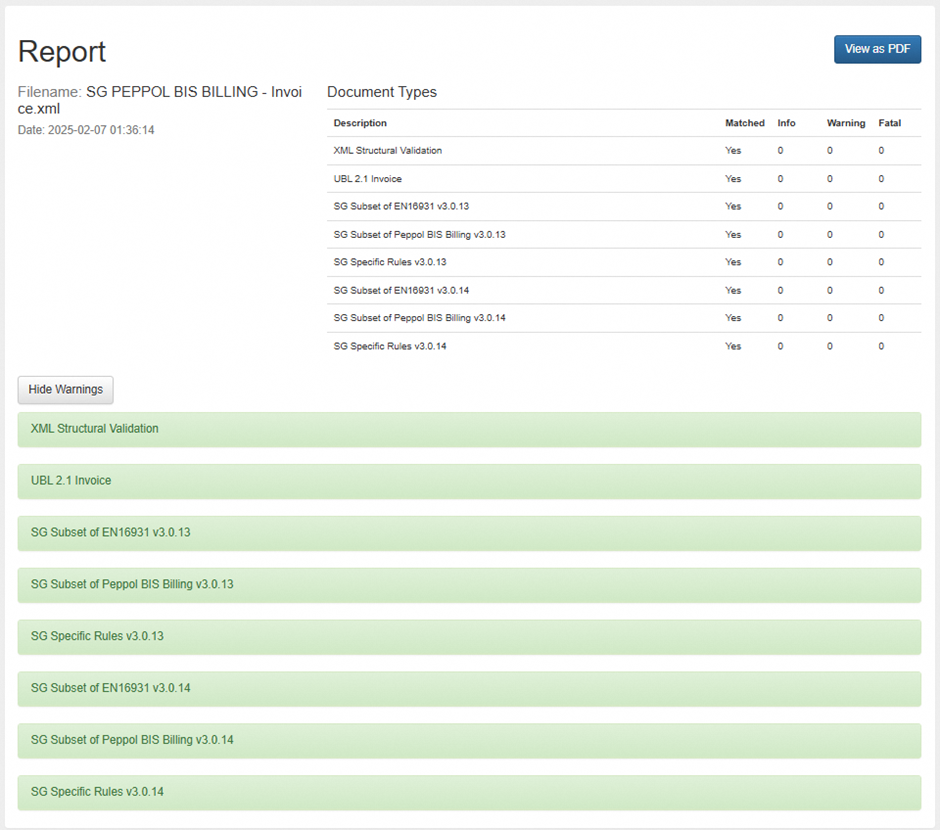

Below are the steps for using the Validex tool.

- Select a document type.

- Upload the XML file of selected document type.

- Validation status will be shown after successful upload.

- Select the “View Report” button for detailed results.

.webp)